About us

FASTPCBA Co.,Ltd

-

Building 1, Senyang Electronic Technology Park, Guangming High-tech Park, Yutang Street, Guangming District, Shenzhen City.

Building 1, Senyang Electronic Technology Park, Guangming High-tech Park, Yutang Street, Guangming District, Shenzhen City.

-

F:86-13418481618

F:86-13418481618

-

[email protected]

[email protected]

date:2020-10-12 16:35:50

date:2020-10-12 16:35:50

The development status and trend analysis of the global PCB industry in 2020: 5G upgrade, the number and price of high-end PCB are rising

PCB is the downstream of copper clad laminates, and it is a large industry with a value of 60 billion U.S. dollars, driving the output value of copper clad laminates to rise. As a bridge that carries electronic components and connects circuits, PCBs are widely used in communication electronics, consumer electronics, computers, automotive electronics, industrial control, medical equipment, national defense, and aerospace. It is an indispensable electronics in modern electronic information products. Components.

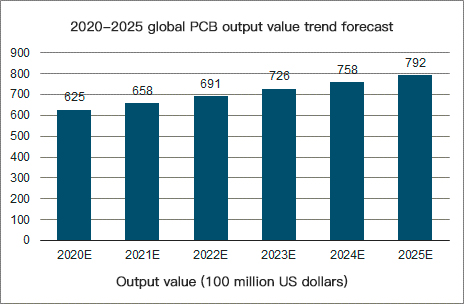

Entering 2020, although the new crown pneumonia disrupted the progress of 5G, countries are still fighting each other in the 5G competition. While the epidemic is burning, countries are monitoring the development of the epidemic through digital technology, and have foreseen the turning point of industries such as 5G, cloud and AI. Future digital life scenarios such as remote teaching, smart diagnosis and treatment, and industrial risk control AI have also been activated in advance. As far as the overall development trend in 2020 is concerned, 5G is still a key driving force for the growth of the industrial economy. It is estimated that the global PCB output value growth rate in 2020 will be 2%, and the output value scale will be approximately 62.5 billion US dollars. From 2020 to 2025, the global PCB output value is expected to grow at an average annual compound growth rate of approximately 5%. In 2025, the global PCB output value is expected to be close to US$80 billion.

(2020-2025 global PCB output value trend forecast)

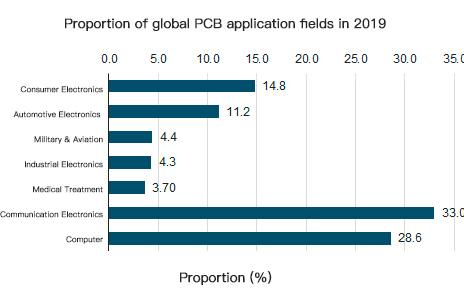

From the perspective of application fields, most PCB market segments also experienced a decline in 2019, but the demand for infrastructure applications such as 5G networks and data centers continued the growth trend in 2018, with the output value of the server/data storage field year-on-year An increase of 3.1%; the computer field including servers/data storage accounted for 28.6% of the global PCB output value. But overall, communication electronics is still the most important application field in the PCB industry, accounting for 33.0% of the global PCB application market in 2019.

(Proportion of global PCB application fields in 2019)

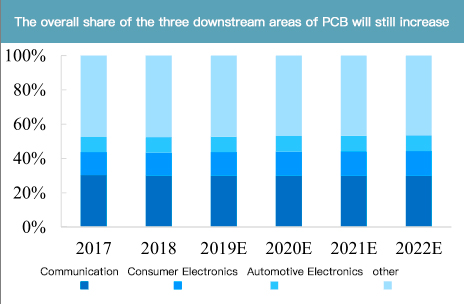

(The overall share of the three downstream areas of PCB will still increase)

5G opens a new round of construction cycle, and base stations, consumer electronics and servers in communication equipment benefit in turn and promote collaboratively. The upgrade of each generation of communication standards is usually accompanied by the construction of upstream base station networks, the shipment of midstream communication equipment vendors, and the popularization of downstream mobile phones; and as the new generation of networks is widely used, the emergence of new application scenarios brings greater Therefore, the expansion of the number of servers in the data center is reversed: the capital expenditure of the operator is transmitted in all links with the pace of construction.

5G brings structural upgrade opportunities for the communication PCB/copper clad laminate industry chain, which will ultimately affect the implementation of "quantity" and "price".

1. Base Station

On the one hand, due to the reduced high-frequency coverage radius of 5G, more base stations are required for the same coverage area. At the same time, changes in the structure of 5G base stations will increase the amount of PCB/copper-clad laminates per station; The demand for copper clad laminates brings an increase in value.

2. Consumer electronics (mobile phone)

Consumer electronics (mobile phones): On the one hand, the increase in the number of 5G mobile phone antennas and transmission lines has promoted the increase in the penetration rate of FPC (flexible circuit board), and the demand for FCCL (flexible copper clad laminate) as a FPC substrate is expected to grow rapidly; on the other hand, 5G massive The connection characteristics are expected to accelerate the emergence and popularization of new consumer electronics, thereby driving the amount of PCB/CCL.

3. Server

New types of applications represented by 5G and cloud computing bring massive data storage and computing requirements, pushing back the expansion of upstream data centers. As a basic component, PCB is expected to usher in rapid growth as the server market rebounds.

Building 1, Senyang Electronic Technology Park, Guangming High-tech Park, Yutang Street, Guangming District, Shenzhen City.

Building 1, Senyang Electronic Technology Park, Guangming High-tech Park, Yutang Street, Guangming District, Shenzhen City.

F:86-13418481618

F:86-13418481618

[email protected]

[email protected]